Estimate payroll deductions

Calculate taxes youll need to withhold and additional taxes. This is 6000 of child support per year.

Payroll Calculator With Pay Stubs For Excel

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Ad Compare This Years Top 5 Free Payroll Software. After entering their gross income consider taxes and. This number is the gross pay per pay period.

6000 of child support over 26 pay periods 6000 divided by 26 23077. Ad Calculate Your Payroll With ADP Payroll. It will confirm the deductions you include on your.

Subtract 12900 for Married otherwise. Take Advantage of Everything Payroll Has To Offer. You can enter your current payroll information and deductions and.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. You can also use the calculator below to get an estimate of what your employees will receive as net income. Payroll Deductions Calculator Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Adjusted gross income Post-tax deductions Exemptions Taxable income. This is how often you are paid. The 2022 Social Security wage base is 147000.

Weekly 52 paychecks per year Every other week 26 paychecks per year Twice a. Get Started With ADP Payroll. Ad Compare Side-by-Side the Best Payroll Service for Your Business.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Learn What EY Can Do For You. Single Married Filing Separately Head.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Standard deduction amount. Subtract any deductions and.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Make Your Payroll Effortless and Focus on What really Matters. Ad Calculate Your Payroll With ADP Payroll.

Figure out how much each employee earned. Get Started With ADP Payroll. Use this calculator to help you determine the impact of changing your payroll deductions.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Get 3 Months Free Payroll. Process Payroll Faster Easier With ADP Payroll.

Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right. Use the pay frequency and information from the employees W-4 to identify which tax table to use see IRS Pub 15-t. All Services Backed by Tax Guarantee.

Withhold 765 of adjusted gross pay for Medicare and. For post-tax deductions you can choose to either take the standard. To run payroll you need to do seven things.

Get your business set up to run payroll. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. For example if an employee earns 1500 per week the individuals.

Get Started With Limited Offers Today. You should withhold 23077 from the employees paycheck every pay. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. The formula is. Ad Scalable Tax Services and Solutions from EY.

2022 Federal income tax withholding calculation. Calculate and deduct federal income tax using the employees W-4 form and IRS tax tables for that calendar year. Computes federal and state tax withholding for.

Only withhold Social Security taxes on wages up. Get Started for Free. Ad Get It Right The First time With Sonary Intelligent Software Recommendations.

Process Payroll Faster Easier With ADP Payroll. Single Married Filing Separately Head of Household. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. The employee pays half 62 and the employer pays the other half 62. You can enter your current payroll.

Get 3 Months Free Payroll. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Free Unbiased Reviews Top Picks.

Solved W2 Box 1 Not Calculating Correctly

Opentaxsolver Payroll Deduction Calculator

Paycheck Calculator Take Home Pay Calculator

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Paycheck Calculator Take Home Pay Calculator

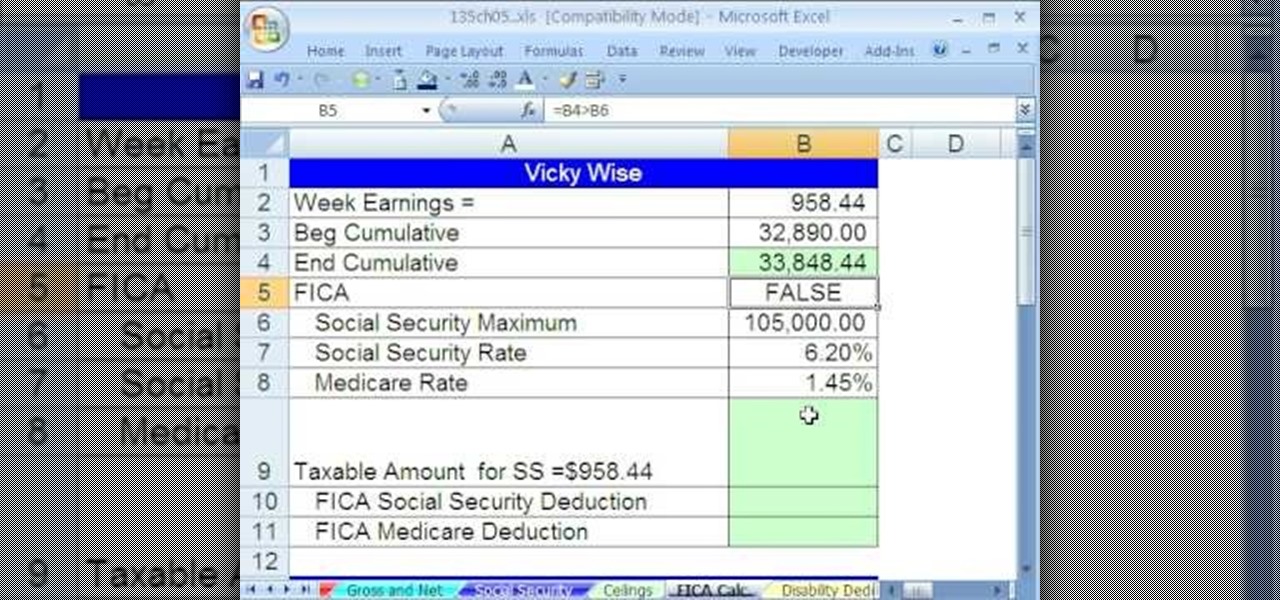

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Tax Calculator For Employers Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll Taxes In 5 Steps

Enerpize The Ultimate Cheat Sheet On Payroll

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Net Pay Step By Step Example

Opentaxsolver Payroll Deduction Calculator